Aramco to use Quadrise technology to make cheaper fuel oil

Aramco to use Quadrise technology to make cheaper fuel oil

SAUDI ARAMCO has approved the use of technology from Quadrise Fuels, a British fuel technology firm, in its refineries under a partnership deal it struck with Saudi-based company Rafid Group.

Quadrise expects to generate commercial revenues from Saudi Arabia within two years, after signing the deal which it believes could transform the kingdom’s power generation sector, its chairman Ian Williams said.

“This is a major milestone,” he said.

Analysts at Westhouse say the deal signalled “tangible progress” and provided Quadrise with access to one of the world’s largest fuel oil markets.

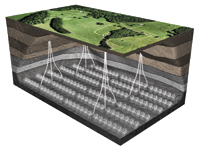

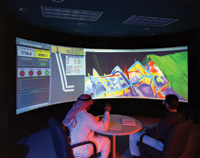

Quadrise’s technology can produce a lower-cost version of heavy fuel oil, made when high-sulphur tarry residue left after the distillation of crude is blended with low-sulphur diesel, which in Saudi Arabia is used for power generation.

A special chemical process means Quadrise can produce fuel oil without using diesel, saving on costs, and potentially making power generation in Saudi Arabia cheaper, something which the company says can offer the kingdom ‘major economic benefits’ as it currently imports some of the diesel used to make fuel oil.

The agreement with Rafid means that Quadrise’s technology is a step closer to being put into a Saudi refinery, following which the company says it expects a larger scale programme to use its expertise in refineries across the country.

“It would be reasonable to expect commercial revenues in Saudi before the end of 2014,” Williams said.

The candidate refinery selected for Quadrise’s technology, which produces the substitute fuel, called MSAR (multiphase superfine atomised residue), alone would represent ‘a company-maker’ in terms of business, Williams added.

MSAR is a direct low cost substitute for conventional heavy fuel oil (HFO) used in marine diesel engines, and for thermal power and steam generation.

MSAR technology is supplied under licence by AkzoNobel. It is a potential game-changer for oil refiners as it frees up valuable distillates traditionally used for HFO manufacture, increasing profitability without incurring significant expenditure.

The global HFO market exceeds 600 million tonnes per annum, of which approximately one third is used in marine applications (as bunker fuel oil).

Westhouse analysts say the relationship with Saudi Aramco could also attract new potential customers in the shape of other oil companies looking to produce cheaper fuel oil, a product which is also used by the shipping industry, an area where Quadrise is also developing a customer base.

“Big oil companies tend to sit up and listen when they observe their competitors entering geographies or business streams,” the analysts said.

The origins of Quadrise lie with a group of former British Petroleum (BP) specialists who worked together with PDVSA, the national oil company of Venezuela, to develop, produce and commercialise an oil-in-water emulsion fuel that could be handled and combusted like fuel oil. This fuel, branded Orimulsion, established a new global market in which over 60 million tonnes were supplied to major utilities.

In 2006 production ceased as a result of political changes and the subsequent reorganisation of PDVSA’s activities.

Quadrise was formed in the 1990s by this same group of former BP specialists who developed new technology to produce MSAR.

.jpg)