Upon completion, the project is expected to see a capacity expansion of 15 per cent

KBR Inc (Kellogg Brown and Root) is likely to engage with international banks to raise finance for the $200m debottlenecking project in Jubail in Saudi Arabia, says Yahya AbuShal, senior project manager at Saudi Aramco Total Refinery and Petrochemical Company (Satorp).

Satorp is planning to debottleneck train II of its existing 440,000bpd refinery in Jubail. In February this year, KBR was awarded the project EPC contract. Satorp is a JV between Saudi Arabian Oil Company (Saudi Aramco) and Total SA.

AbuShal declined to reveal the names of the banks but says that KBR is likely to initiate discussions with banks that are on Aramco’s vendor list.

An email sent to Aramco for comments went unanswered.

Upon completion, the project is expected to see a capacity expansion of 15 per cent. The project is slated for completion by 3Q20.

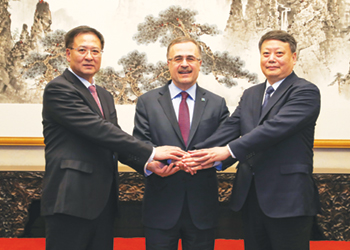

In February, KBR also appointed Wison Engineering, a subsidiary of Wison Group, as a subcontractor for the project.

A previous media report had quoted Jay Ibrahim, KBR president, Hydrocarbons – Energy Services as saying, "We value the partnership we have with Satorp, which has been built on KBR’s strong delivery track record. This award signifies Satorp’s trust in KBR to deliver this schedule critical project to support the upcoming major refinery turnaround in 2020."

With more than 90 years of industry experience in the global energy sector, KBR is recognised as a global leader in providing a wide range of services from stand-alone refining studies to front end engineering design (Feed), project management consulting (PMC), EPC turnkey solutions, and fully outsourced maintenance solutions.

With 18 per cent of the world’s proven petroleum reserves, the state-owned Saudi Arabian Oil Company (Saudi Aramco) continues to expand fields and production and discover new fields. The company intends to double its gas production per day over the next decade to meet domestic needs and reduce the use of oil for domestic power.

The latter will be done by committing $10 billion to its unconventional exploration and developing its shale gas reserves for the country’s power needs.

According to Middle East business intelligence tool Meed, Aramco is forecast to spend approximately $414 billion over the next 10 years on material and services to support service facilities, infrastructure, oil drilling and maintenance, and the exploration and development of unconventional resources.