The increasing role of the private sector in both power generation and water could boost opportunities for large-scale transactions in Mena in the future, according to an EY report.

The leading professional services firm’s Power Transactions and Trends report stated that with market reform gaining momentum as well as utility unbundling, renewables looks to be a fertile growth area.

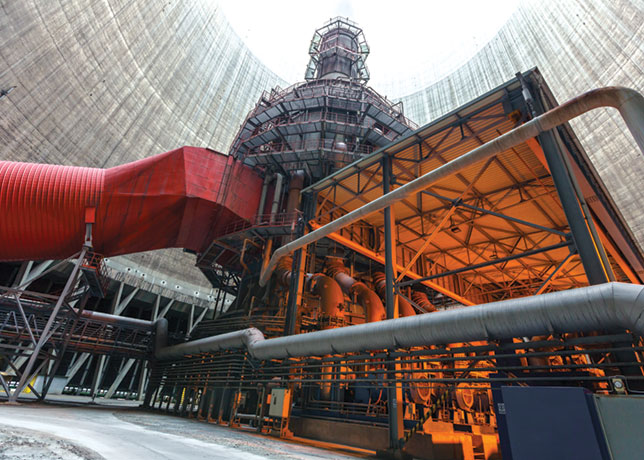

David Lloyd, Mena Power and Utilities Transactions leader, said: “At present, utilities in the Gulf are focusing chiefly on domestic investment. There is a massive need for new power and water capacity, driven by population growth and the increased industrialisation of the region’s economies.

“The projections for new capacity over the next few years encompass not just generation but basic infrastructure. This demand will open up substantial opportunity for private sector involvement and transactions.”

The transaction activity in the GCC is largely based on participation of the private sector in capital projects and commercial undertakings, said the report. As markets and competition in power generation becomes more established, growth rather than consolidation is expected to be a dominant driver of activity, and more deals to be done between state-owned businesses and the private sector, it said. Despite the focus on growth, oil and gas deals are still being completed between both companies already based in the Gulf and between international players.

A number of Middle East funds are also planning to diversify their investments and acquire assets across the globe.