Santos shares slid to a decade low after Standard & Poor’s cut its credit rating and warned a further downgrade was possible if oil prices fell further or the company faced delays or cost overruns on its main gas project.

In the agency’s first energy company downgrade globally since revising its oil and gas price outlook last week, S&P cut Santos’ corporate rating to ‘BBB’ from ‘BBB+’.

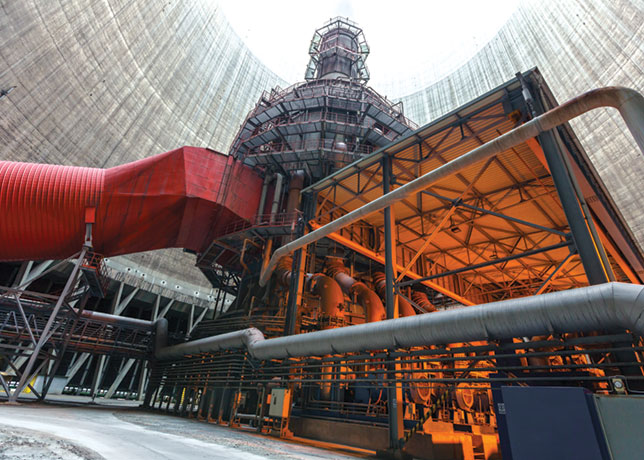

The move reflected the oil price dive and Santos’ A$2.7 billion ($2.2 billion) capital spending plan for 2015, as it completes its key growth project, the $18.5 billion Gladstone liquefied natural gas (GLNG) project.

“We kept the outlook on negative reflecting our view that there is a risk of a prolonged period of weak oil prices, which will hinder the recovery of Santos’ credit metrics in 2016,” S&P analyst Craig Parker told analysts and reporters on a conference call.

Santos shares fell a further 10 per cent, taking the stock to a 10-year low at A$7.46. The stock has halved since June, while benchmark Brent crude has plunged 43 per cent over the same period.