Schneider Electric expects strong growth in North America next year despite a slump in oil prices that is threatening one of its key customer segments, the company’s regional chief told Reuters.

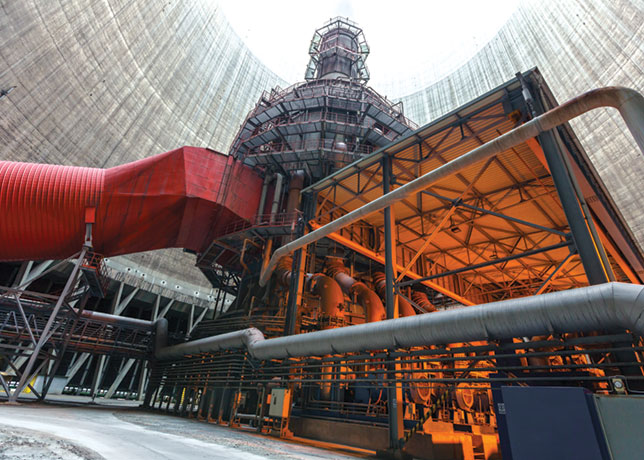

The European multinational, which produces electrical equipment and software, has said the oil and gas industry is one of three of its North American growth areas, alongside infrastructure and data processing. North America accounts for a quarter of the company’s revenue.

“We believe that the overall oil and gas boom is still in its early phases,” said Laurent Vernerey, chief executive officer of Schneider’s North America business. “Is it a bump in the road? Yes.”

Oil prices have dropped by a third since June amid a battle for market share between heavyweight Organization of the Petroleum Exporting Countries (Opec) nations and North American producers ramping up output from shale deposits, oil sands and the deep sea. That has threatened some of Schneider’s energy-related customers, from exploration companies to pipeline operators and refiners seeking electronic equipment and automation software.

“The first thing we will see is the postponement of projects,” Vernerey said. But he added that the impact for Schneider would be offset by improvements in sectors where low oil prices are a boon. Vernerey said his company’s internal forecast models also showed the decline in oil prices would be short-lived because producers in the Opec could probably not sustain their budgets for long before having to cut production.

“Business models are there to be challenged,” he said. “But our view right now is (oil prices) will return.”

Vernerey said Schneider was “bullish about the US” because of rising demand there for cloud computing products and the need for the nation to enhance efficiency and reliability of infrastructure like the electrical grid and water. “Today less than 30 per cent of the US utilities are smart,” he said. “The same thing with water. Some 25 to 30 per cent of the water gets wasted.”

He said he expected single-digit growth in Canada due to a soft residential market and was optimistic about prospects in Mexico after political uncertainty over political reforms hurt growth there earlier in the year.