Nasser ... Sabic stake buy could delay IPO

Nasser ... Sabic stake buy could delay IPO

The initial thinking is to buy the full stake owned by PIF, but if that fails Aramco could end up with a stake of more than 50 per cent

Saudi Aramco aims to buy a controlling stake in petrochemical maker Sabic, possibly taking the entire 70 per cent stake owned by Saudi Arabia’s sovereign wealth fund, two sources familiar with the matter told Reuters.

Late last week Aramco confirmed a Reuters report that it was working on a possible purchase of a 'strategic stake' in Saudi Basic Industries Corp (Sabic) from the Public Investment Fund, the kingdom’s top sovereign wealth fund.

Aramco’s initial thinking is to buy the full stake owned by the Public Investment Fund (PIF), but if that fails to materialise Aramco could end up with a stake in Sabic of more than 50 per cent, making it a majority owner, the sources said.

No final decision has been made on the size of the stake as the discussions are still at a very early stage, they added.

Aramco declined to comment. The PIF did not respond to a Reuters request for comment.

Riyadh-listed Sabic, the world’s fourth-biggest petrochemicals firm, has a market capitalisation of 385.2 billion Saudi riyals ($103 billion).

The potential acquisition would affect the time frame of Aramco’s planned initial public offering set for later this year, the state oil giant’s chief executive, Amin Nasser, said in a TV interview.

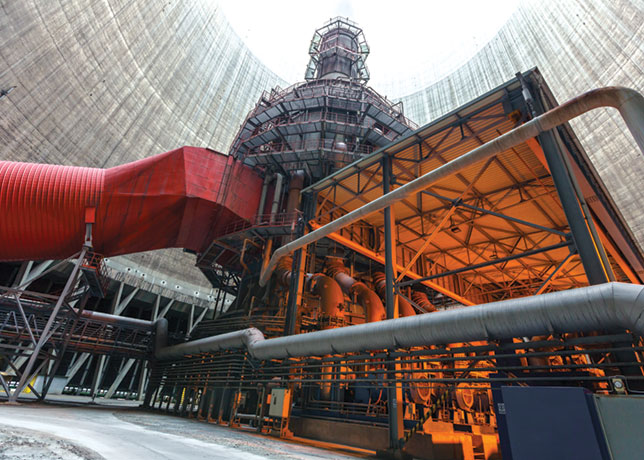

Aramco plans to boost investments in refining and petrochemicals to secure new markets and sees growth in chemicals as central to its downstream strategy to cut the risk of an oil demand slowdown.

Aramco plans to raise its refining capacity to between 8 million and 10 million barrels per day, from around 5 mbpd now, and double its petrochemicals production by 2030.

Aramco, the world’s largest oil producer, pumps around 10 mbpd of crude oil.

Meanwhile, Saudi Aramco’s potential acquisition of a stake in Sabic would affect the timeframe of its own planned initial public offering, the firm’s chief executive, Amin Nasser, said in a TV interview.

The offering is the centrepiece of an ambitious plan championed by Crown Prince Mohammed bin Salman to diversify Saudi Arabia’s economy beyond oil, but preparations for the IPO, which could prove the biggest in history, have slowed.

Saudi-owned Al Arabiya television cited Nasser as saying that buying a stake in a petrochemicals company would make the state oil giant less vulnerable to price volatility.

'If the deal is completed, with relevant regulations taken into account, it will definitely affect the timeframe for the partial IPO of Saudi Aramco,' he said in a transcript provided by the government media office.

Aramco said it was looking to buy a strategic stake in Sabic, which could boost its market valuation ahead of a planned IPO.

When Aramco is ready to list, the IPO timing would be up to the government to decide, Nasser said.

'As I said in previous interviews, when Saudi Aramco is ready, the decision of going ahead with the IPO is for the state to make,' he said

Aramco said it was in 'very early-stage discussions' with the kingdom’s Public Investment Fund (PIF) to acquire the Sabic stake in a private transaction, and had no plans to acquire any publicly held shares.

Riyadh-listed Saudi Basic Industries Corp (Sabic), the world’s fourth-biggest petrochemicals company, is 70 per cent owned by the PIF, Saudi Arabia’s top sovereign wealth fund. It has a market capitalisation of 385.2 billion Saudi riyals ($103 billion).

Nasser also said Aramco had a long-term goal to convert 2 million to 3 million barrels of its oil products into chemicals.

Nasser said the proposed deal with Sabic would help balance revenues from excavation and production with those from refining and chemicals, that normally remain strong even when oil prices dip.