Reliance ... standing to benefit from ties with Aramco

Reliance ... standing to benefit from ties with Aramco

Aramco sees India’s biggest private oil company, Reliance, as a viable route to pump funds into India downstream market and expand its options beyond state-run firms

Saudi Aramco and Reliance Industries have intensified discussions on potential joint venture opportunities in India’s downstream sector, a sign that the Middle Eastern producer is keen to accelerate its investment plan into top gear in one of Asia’s fastest growing oil markets.

A series of meetings between the top management of Reliance and Saudi Arabian officials have prompted oil analysts to say that Aramco is likely to play a crucial part in any potential refining and petrochemical expansion that Reliance decides to pursue in the future.

With its ambitious joint venture with Indian state-run refiners expected to fall behind schedule, Aramco sees India’s biggest private oil company, Reliance, as a viable route to pump funds into India’s downstream market and expand its options beyond Indian state-run firms.

"Saudi Aramco is seeking a foothold in India’s refining and petrochemical sectors, especially if it can get to supply crude as part of the deal," says Lim Jit Yang, director of Asia-Pacific oil market analysis at S&P Global Platts Analytics.

"Partnering with a successful and well-known company like Reliance would not only help it understand the local markets, there is also a good chance that plans will get executed in a timely manner," he added.

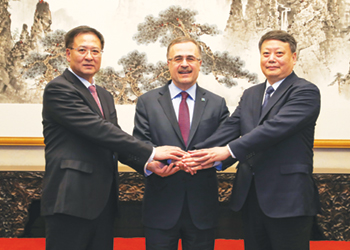

Immediately after meeting Reliance chairman Mukesh Ambani late last year, Saudi oil minister Khalid Al Falih tweeted: "I was delighted to meet Mukesh Ambani, chairman of the board of Reliance Industries with whom I discussed joint investment and cooperation opportunities in petrochemicals, refining, and telecommunications."

And earlier this month, Ambani held a meeting with Aramco’s chairman Amin Nasser. Aramco says the meeting was for Reliance to learn more about Aramco’s "frontiers," including crude and chemicals.

Falih and Nasser were also a part of the high-profile delegation accompanying the Saudi Crown Prince Mohammed bin Salman’s visit to New Delhi earlier in February.

During the visit, the kingdom pledged to invest $100 billion in India, with the bulk of funds going toward infrastructure and energy sectors, including downstream segments like refining and petrochemicals.

One of the biggest downstream projects planned in India is the Ratnagiri project—a mega refinery and petrochemicals complex on the west coast—with a refining capacity of 60 million mt/year (1.2 mbpd).

It is being jointly built by state-run refiners Indian Oil Corp, Hindustan Petroleum Corp Ltd and Bharat Petroleum Corp Ltd, with Aramco and Abu Dhabi National Oil Co having signed an initial agreement to jointly take a stake in that project.

"We are not limited to that investment, which is the mega refinery," Nasser added. "We are looking at other opportunities. India is an investment priority for Saudi Aramco. There is a lot of growth potential. We are in discussions with other companies as well, including Reliance Industries."

Although officials in charge of the Ratnagiri project have says they were hopeful that the project would move ahead soon and have expressed confidence the plant would be commissioned by 2025, some analysts have says the project could face delays as the land acquisition process had not yet been completed.

"The delay in the Ratnagiri project is no doubt a disappointment for Saudi Arabia although it seems they are firm to be a part of it," says Sri Paravaikkarasu, Director, Asia Oil, at Facts Global Energy.

"Meanwhile, the recent move to aim for tie-ups with Reliance could be seen as a strategic decision by Aramco to nurture other potential energy opportunities in India. Reliance has been considering to expand their petrochemical portfolio in the Indian domestic market," she added.

In India, Reliance operates the world’s biggest refinery operation at Jamnagar in the western Indian state of Gujarat with a combined capacity of more than 1.2 mbpd, while its annual runs are close to 1.4 mbpd.

Although Reliance has remained tight-lipped on any possible refining expansion plans, oil ministry sources have says that the company had received clearance to raise its capacity, but have not specified a number.